year end accounts extension

Year-end attendance and fiscal reports are due by July 20 2021. A delinquent report results in withholding any remaining apportionments due for FY 202021.

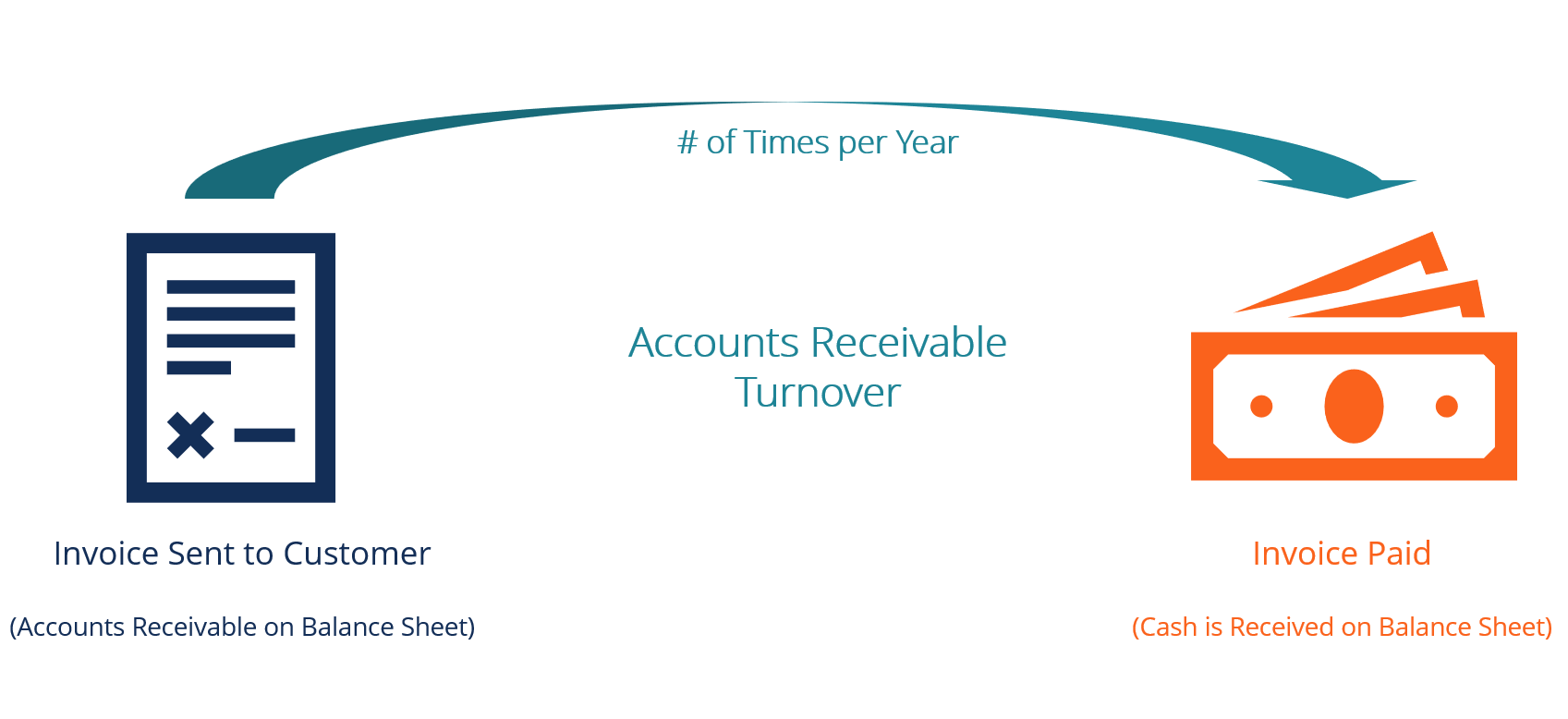

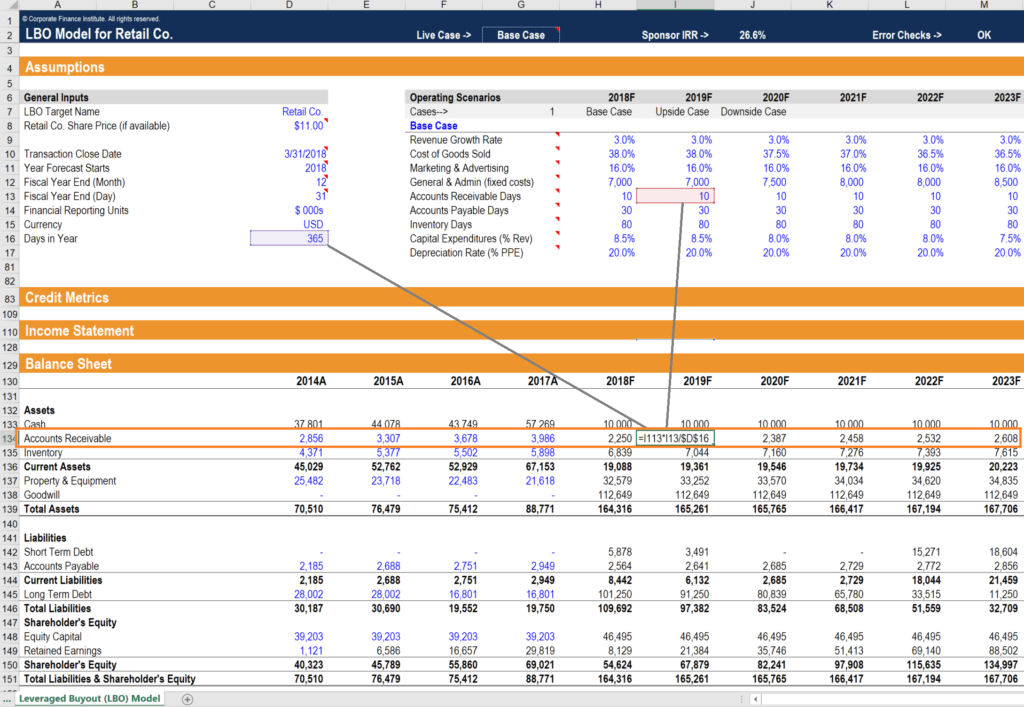

Accounts Receivable Turnover Ratio Formula Examples

YesNo If yes name of organization.

. Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every 5 years. Companies may change their year-end by shortening their financial year by a minimum of 1 day as many times as they like. Year-End Reports Reporting Deadline.

Yes Companies House say that the extension from 9 months to 12 months for a private limited company to file accounts at Companies House applies where the ordinary 9 month deadline would fall on or before 5 April 2021 and on or after 27 June 2020. This joint initiative between the government and Companies. To confuse the issue the IRS says a fiscal year is 12.

The fiscal year is expressed by stating the year-end date. FISCAL YEAR-END PROCESSES IN ACCOUNTING SOFTWARE Accounting Software Microsoft Dynamics GP TipsSteps to Complete Prior to Fiscal Year-End Close. Apply to extend your accounts filing deadline Use this service to apply for more time to file your annual accounts with Companies House.

Review end-of-year checklist for Bookkeeper Review end-of-year checklist for County Program Director Report configurations for MCHCP University Subsidy. Received 669200 cash in payment of acc receivable. 1345434 - 18300 - 669200 657934 0015 986901 18300 2816901.

However after processing the first twelve months you can use the Change Financial Year facility to move the financial year to the last twelve months of your year. You have a clear outline of what you want to achieve which tends to result in less stress and quicker outcomes. Adjusted the year-end accounts for the accrued interest earned on the White note.

February has 28 days for the current year. The FBAR is an annual report due April 15 following the calendar year reported. Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every five years.

Yet often they are a last minute affair and proper attention is not accorded the tasks. NEW employee co-pay or deductible reimbursements. This extension includes dormant company account too.

A fiscal year-end is usually the end of any quarter such as March 31 June 30 September 30 or December 31. 1 Accepted a 10000 180-day 9 note dated November 1 from Kelly White in granting a time extension on her past- Dec. 30 White honored her note when presented for payment.

The year-end tasks in accounts payable are critical to accurate financial statements for any organization. Companies may change their year end by shortening their financial year by a minimum of one day as many times as they like. You will have 12 months to submit your accounts instead of the standard 9 months filing deadline.

It is any 12-month period that the company uses for accounting purposes. This course is designed to highlight the issues both directly related to the year-end close and present information the professional can use to implement a smoother close in accounts. The help section has Sage 50 Accounts only enables a twelve month financial year.

Melissa Burrow Interim Extension Educator. Tennessee Extension Master Gardener Program 2016 Annual Year-End Financial Summary Organized as a separate 501c3. Wrote off 18300 of uncollectible.

Replying to lionofludesch. Acceptable reports not received by July 20 2021 will be considered delinquent. _____ Year End as of _____.

31 or June 30 15th day of 3rd month after year-end 15th day of 9th month after year-end. For examples a private limited company with an accounting year-end date of 31 March 2020. Now that businesses have had time to adjust to the changed environment we intend to end the temporary relief in stages over the coming months as follows.

15 C Corporation Fiscal Year End other than Dec. Bad Debts Exp 28169. To adjusting the accounts on December 31 the company estimated that 15 of accounts receivable will be uncollectible.

You will also need to file a directors report unless your company is a micro-entity. Revenue Expense Summary. To do this you will need your company accounts and your corporation tax calculation.

Additionally apportionments for FY 202122 beyond the initial. So if a company is set up on 25th March 2017 it will have a normal year end date of 31st March 2018 and its accounts will be due for filing by 25th December 2018. Depending on the size of your company you.

Assume no reversing entries were made on January 1. Accepted a 17000 180-day 8 note from Kelly White in granting a time extension on her past-due account receivable. Companies House will extend your filing deadline to 31 March 2021.

June 30 year-ends including those with other fiscal year-ends will be due on the 15th of the 4th month after the year-end. When to File. 7999-Fee Generation expense account.

The version they are using is Sage 50 Accounts Professional 2011 version 17015208. 03rd Jul 2020 1101. Class Code Structure Apply class 4000 to savings and investment bank.

Youre allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15. A companys fiscal year is its financial year. You will need to file your company tax return also known as the CT600 form online.

Private limited companies LTD accounts. White honored her note when presented for payment. You dont need to request an extension to file the FBAR.

15 April 15 Oct. From today 25 March 2020 businesses will be able to apply for a 3-month extension for filing their accounts. Filing Company Year End Accounts with HMRC.

A six-month extension is allowed from that date. See FinCENs website PDF for further information. For more information or help on starting the new year right contact me at mburrowumnedu or Houston County Extension at 507-725-5807 or Fillmore County Extension at 507-765-3896.

Its purpose is to review the accounting records and financial statements prepared by. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. If it shortens its first accounting period to 31st December 2017 then its accounts will still be due for filing by 25th December 2018 as this is later than 3 months after the new accounting period which would.

Employees that have also received Payables check the vendor should be set-up exactly the same way the employee appears on the Published Report so there is only 1 entry. For funds with an annual or half-yearly accounting date on or before 31 August 2020 the temporary relief will remain in place. Accounts for Companies House and Company Tax Returns for HMRC - what you must send deadlines filing separately or together.

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Important Statutory Due Dates For Llp Annual Filing Fy 2020 21 Ebizfiling

Professional Service Automation Psa App App Development Professional Services Resource Management

Accounts Receivable Turnover Ratio Formula Examples

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Understanding Profitability Ag Decision Maker

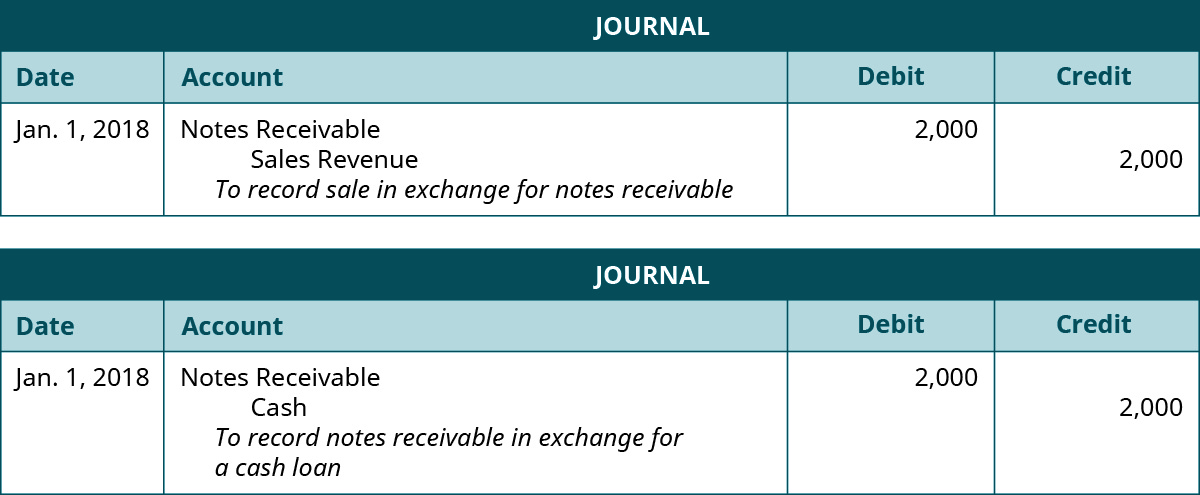

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

Building The System Of National Accounts Measuring Quarterly Gdp Statistics Explained

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

Your Accounting Basics Psa You Have One Week To File Your Taxes If You Filed An Extension The Countdown Is On Acc Tax Extension Tax Time One Week

Accounts Receivable Turnover Ratio Formula Examples

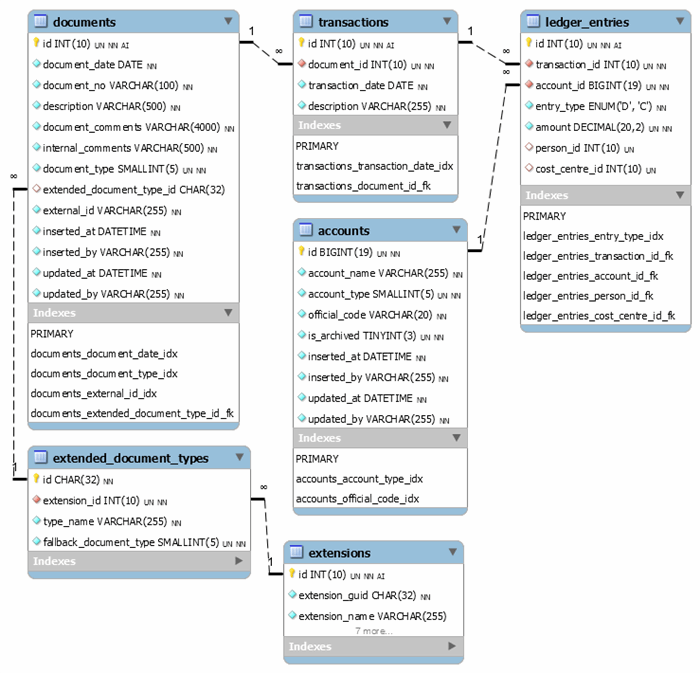

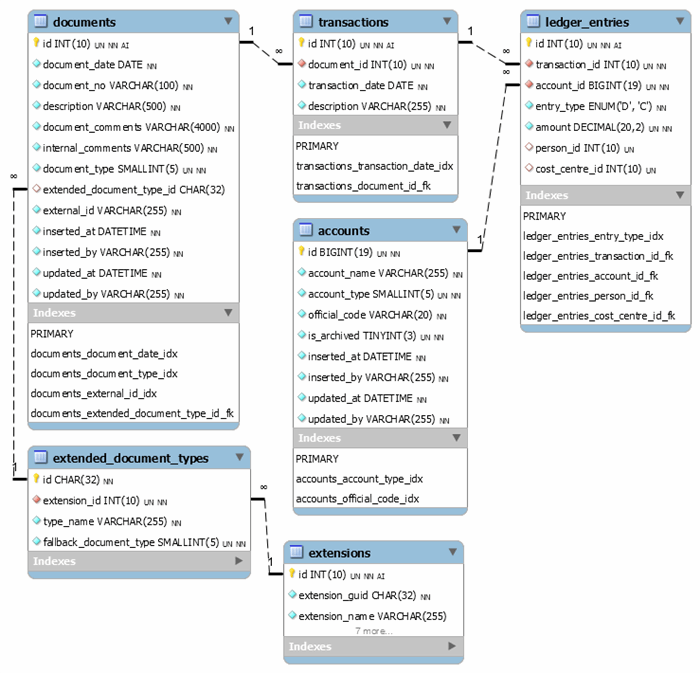

Database For Financial Accounting Application Ii Infrastructure Codeproject

How To Get An Additional Tax Extension H R Block

Understanding Profitability Ag Decision Maker

Accounts Receivable Turnover Ratio Formula Examples

Understanding Profitability Ag Decision Maker

Accounting For Senior Cycle New Fourth Edition 2021 In 2022 New Students Student Activities Textbook